하루만 맡겨도 이자를 주는 파킹통장 금리비교 24.6.20 금리가 한눈에 하루만 맡겨도 이자를 주는 파킹통장 금리비교 24.6.20 금리가 한눈에

2024. 6월 파킹통장 금리비교 하루만 넣어둬도 이자를 주는 파킹통장은 원할 때 언제든지 입출금할 수 있는 ‘수시입출금통장’이다. 월급, 여유자금으로 이자를 받거나 비상금, 단기자금을 예치할 때 돈을 쓸 곳이 있다면 파킹통장에 종잣돈 일부를 맡겨두는 것도 추천 🙂 ‘수시’ 입출금 통장이지만, 다만 주의할 점은 다른 은행으로 이체할 때 한도가 있고, 만약 한도 제한이 있다면 미리 해제해야 한다. #멋대로 들어가도 #나올때는 누구 마음대로 >> 2024. 4월 파킹통장 이자비교 ↓↓↓ 2024. 6월 파킹통장 금리비교 하루만 넣어둬도 이자를 주는 파킹통장은 원할 때 언제든지 입출금할 수 있는 ‘수시입출금통장’이다. 월급, 여유자금으로 이자를 받거나 비상금, 단기자금을 예치할 때 돈을 쓸 곳이 있다면 파킹통장에 종잣돈 일부를 맡겨두는 것도 추천 🙂 ‘수시’ 입출금 통장이지만, 다만 주의할 점은 다른 은행으로 이체할 때 한도가 있고, 만약 한도 제한이 있다면 미리 해제해야 한다. #멋대로 들어가도 #나올때는 누구 마음대로 >> 2024. 4월 파킹통장 이자비교↓↓↓

주차통장 금리비교 l 4월 최신판 변경사항&주의사항 (저축은행 금리 한눈에 보기 권장) 파킹통장 금리비교 2024.4월 최신판 2024.4월 파킹통장 금리비교 파킹통장 = 수시입출금통장 파킹… blog.naver.com 파킹통장 금리비교 l 4월 최신판 변경사항&주의사항 (저축은행 금리 한눈에 보기 권장) 파킹통장 금리비교 2024.4월 최신판 2024.4월 파킹통장 금리비교 파킹통장 = 수시입출금 통장 파킹… blog.naver.com

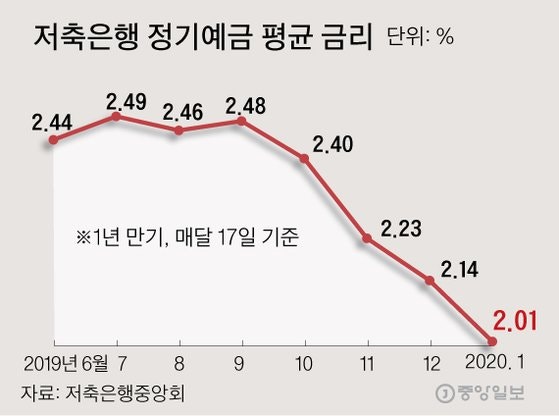

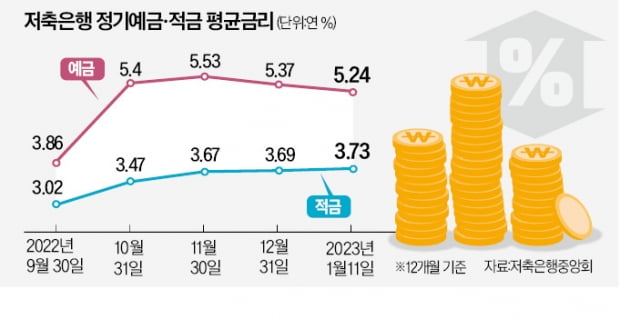

2024년 6월 최신판 전체적으로 대출은 물론 예적금 금리도 떨어지는 추세여서 파킹통장 금리가 좋은 곳은 연 3%대 초반 2%로 내려간 곳도 있다. 토스뱅크 통장은 연 1.8%… 우선 이번 글에서는 저축은행을 중심으로 파킹통장 금리 비교. 파킹통장만 보면 저축은행이 그래도 금리가 좋으니 소개하지만, 예금자보호 5천만원이 되는 범위로 나눠 안전한 곳에 맡기는 것을 추천한다 2024년 6월 최신판 전체적으로 대출은 물론 예적금 금리도 떨어지는 추세여서 파킹통장 금리가 좋은 곳은 연 3%대 초반 2%로 내려간 곳도 있다. 토스뱅크 통장은 연 1.8%… 우선 이번 글에서는 저축은행을 중심으로 파킹통장 금리 비교. 파킹통장만 보면 저축은행이 그래도 금리가 좋으니 소개하지만, 예금자보호 5천만원이 되는 범위로 나눠 안전한 곳에 맡기는 것을 추천한다

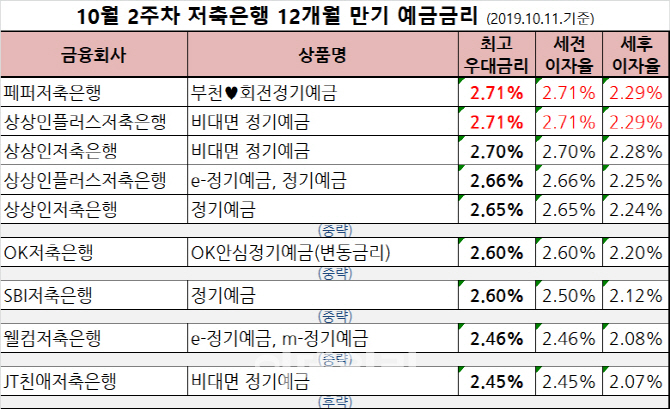

★새로 변경된 곳은 적색표시 (금리는 연%, 세전) ★새로 변경된 곳은 적색표시 (금리는 연%, 세전)

OK Savings Bank OK Salty Tech Bank Account 연 7% per year is up to 500,000 won. It is applied up to 100 million won, and in fact, 3.3% per year OK, OK. Ordinary deposits tend to gradually fall to 2% when interest rates are compared with 2.5% 까지 up to 100 million won. This 이다, OK Savings Bank OK Salty Tech Bank Account 7 7% per year is only up to 500,000 won. It is applied up to 100 million won, and in fact, 3.3% per year OK, OK. Ordinary deposits tend to gradually fall to the 2% 보니 after comparing interest rates up to 2.5 percentage 까지 up to 100 million won. 이다。

From OK Savings Bank account inquiry to transfer, a new OK Savings Bank has been opened easily through mobile banking! Install and experience the mobile app! Mobile app download We will always bring happiness and satisfaction by illuminating the future of customers of Korea’s leading global financial group. “Looking at the bank introduction,” “Looking around OK Financial Group,” “OK Savings Bank Uman,” “Idsa,” and “Our Hero Uman” will be able to defeat Idsa and regain the city center that has turned into a stone? We support various sports sponsors such as 30-second ads, 15-second ads, Yes, installment savings products, sports sponsorship, professional teams, national teams, and sports hopefuls. Major activities OK Savings Bank Rush & Cash Volleyball Group…www.oksavingsbank.com OK Savings Bank’s account inquiry to transfer has been easily opened through mobile banking! Install and experience the mobile app! Mobile app download We will always bring happiness and satisfaction by illuminating the future of customers of Korea’s leading global financial group. “Looking at the bank introduction,” “Looking around OK Financial Group,” “OK Savings Bank Uman,” “Idsa,” and “Our Hero Uman” will be able to defeat Idsa and regain the city center that has turned into a stone? We support various sports sponsors such as 30-second ads, 15-second ads, Yes, installment savings products, sports sponsorship, professional teams, national teams, and sports hopefuls. Major activities OK Savings Bank Rush & Cash Volleyball Team…www.oksavingsbank.com

I’ll figure out how much it will cost even if I get 500,000 won a year and 7% a year I’ll figure out how much it will cost even if I get 500,000 won a year and 7% a year

No language detected.

Please check the input language, no language detected.

Please check the input language.

It’s close to 30,000 won rather than a year’s deposit standard. I think it’s not as bad as I thought when I think I’m going to eat a chicken even though it’s 500,000 won less than I thought. Well, it’s much better to use stock-like investments in terms of interest rate comparison these days… because it’s about 500,000 won?? It’s close to 30,000 won rather than a year’s deposit standard. I think it’s not as bad as I thought when I think I’m going to eat a chicken even though it’s 500,000 won less than I thought. Well, it’s much better to use stock-like investments in terms of interest rate comparison these days… because it’s about 500,000 won??

Savings Bank Parking Account Interest Rate Comparison Changes Savings Bank Parking Account Interest Rate Comparison Changes

NH Savings Bank (NHFIC_One) and KB Savings Bank (KIWI Pampang Account) are parking accounts that meet the basic interest rate plus preferential interest rates and receive them in the 3% range per year. Marketing reception, automatic transfer, other bank transfer, or easy transaction performance. The terms of preferential interest rates are similar. It’s not that difficult, but if you’re too lazy, pass to the next bank~~ NH Savings Bank (NHFIC_One) and KB Savings Bank (KIWI Pampang Account) are parking accounts that meet the basic interest rate plus preferential interest rates and receive them in the 3% range per year. Marketing reception, automatic transfer, other bank transfer, or easy transaction performance. The terms of preferential interest rates are similar. It’s not that difficult, but if you’re too lazy, pass to the next bank~~

NH Savings Bank Account Inquiry Immediate Transfer/Delayed Transfer/Delayed Transfer/Deposit Loan Interest Payment/Principal Reimbursement Certification Center 12 months before tax/Advance Rate 3.3% per annum (Fixed Rate) 12 months before tax/Advance Rate 4.1% per annum) Customer Service 1588-5191 Help Desk Complaint Contact Remote Support Loan Consultation 1566-9574. 1% preferential interest rate applied) Customer Service 1588-5191 Help Desk Complaint Window Remote Support Loan Consultation Only 1566-9574 Certificate Issuance Vulnerable Borrower Priority Self-debt Adjustment Guide www.nhsavingsbank.co.kr

No language detected.

Please check the input language, no language detected.

Please check the input language.

KB Savings Bank’s Kiwi Bread Basic, Preferential Interest Rate KB Savings Bank’s Kiwi Bread Basic, Preferential Interest Rate

As a result, SBI Savings Bank’s bank account simply provides 2.9% per year without having to meet preferential interest rates. Originally, it was 3%, but this time interest rates fell a little to the 2% range, while SBI Savings Bank’s bank account simply provides 2.9% per year without having to meet preferential interest rates. It was originally 3%, but this time interest rates fell a little and entered the 2% range

2.9% per year up to 50 million won 2.9% per year up to 50 million won

감지된 언어가 없습니다.

입력 언어를 확인해 주세요.

comparison of interest rates at savings banks comparison of interest rates at savings banks

In April, there was no significant change in comparison between the book and interest rates, and it is noteworthy whether Acuon Savings Bank’s <Monthly Plus> occasional deposit and withdrawal accounts were newly created. Parking passbook up to 3.8% including 0.7% annual preferential interest rate In April, there was no significant change in comparison between the book and interest rates, and it is noteworthy whether Acuon Savings Bank’s <Monthly Plus> occasional deposit and withdrawal accounts were newly created. Parking passbook up to 3.8% including 0.7% annual preferential interest rate

Acuon Savings Bank (salary plus) Acuon Savings Bank (salary plus)

If the preferential interest rate itself is annoying, you can receive +1% and earn 3.1 to 3.2% per year with more than 1 million won in income transfer performance. Preferential interest rate applied up to 50 million won If the preferential interest rate itself is annoying, you can receive +1% and earn 3.1 to 3.2% per year with more than 1 million won in income transfer performance. Preferential interest rate applied up to 50 million won

No language detected.

Please check the input language, no language detected.

Please check the input language.

Please note that Plus Free Deposit is different from other products that receive monthly interest (the third Friday of March, June, September, December) because interest is paid quarterly. There will be no difference in the amount of interest itself, but it is paid quarterly every three months, so please refer to it. It is a method in which 0.2% preferential interest rate is added to the basic 3.3%. Please note that Plus Free Deposit is different from other products that receive monthly interest (the third Friday of March, June, September, December) because interest is paid quarterly. There will be no difference in the amount of interest itself, but it is paid quarterly every three months, so please refer to it. It is a method in which 0.2% preferential interest rate is added to the basic 3.3%.

Daishin Savings Bank’s parking passbook Daishin Savings Bank’s parking passbook

Instead, the interest rate on Dodrigo’s deposit and withdrawal bankbook (parking bankbook) will be lowered to 3.0 percent a year compared to the previous month. Instead, the interest rate on Dodrigo’s deposit and withdrawal bankbook (parking bankbook) will be lowered to 3.0 percent a year compared to the previous month.

Instead, savings banks are quick and easy anytime, anywhere! Instead, Internet banking at savings banks! Banks that have access to banking services such as credit loans, deposits, installment savings, and transfer payments. daishin.com Instead, savings banks are quick and easy anytime, anywhere! Instead, Internet banking at savings banks! Banks that can use banking services such as credit loans, deposits, installment savings, and transfer payments. daishin.com

Hana Savings Bank High Hana Savings Basic Interest Rate + Preferential Interest Rate 0.5% Hana Savings Bank Basic interest rate on ordinary deposits + 0.5% preferential interest rate

Full consent to information collection and product service guidance, 2 million won is filled at the end of each month, and there is no paper bankbook. If these three are met, it is easy to receive all 0.5% of the total preferential interest rate. Full consent to information collection and product service guidance, 2 million won is filled at the end of each month, and there is no paper bankbook. If these three are met, it is easy to receive all 0.5% of the total preferential interest rate.

Hana Savings Bank, Hana OneQ Savings Bank, Hana Financial Group, non-face-to-face account opening, deposits, installment savings, credit loans, and branches. www.hanasavings.com Hana Savings Bank, Hana OneQ Savings Bank, Hana Financial Group, non-face-to-face account opening, deposits, installment savings, credit loans, and branches. www.hanasavings.com

Now, an occasional deposit and withdrawal passbook (parking passbook) that gives interest rates in the 2% range. It’s raining a lot T_TKDB Development Bank Hi Non-face-to-face deposit and withdrawal account amount is 2% per year without restrictions. K-Bank Plus Box is an occasional deposit and withdrawal account (parking account) that gives interest rates of 2.3% per year and 2% per year. It’s raining a lot T_TKDB Development Bank Hi Non-face-to-face deposit and withdrawal account amount is 2% per year without restrictions. K-Bank Plus Box is 2.3% per year

Meanwhile, Toss Bank lowered interest rates on parking accounts like a leader in Internet banks =. =; #Toss Bank passbook #I’m sorry I couldn’t protect you 1.8% TT What should I do about the temperature difference from last year’s production year.. Meanwhile, Toss Bank lowered interest rates on parking accounts like a leader in Internet banks =. =; #Toss Bank passbook #I’m sorry I couldn’t protect you 1.8% TT What should I do about the temperature difference from last year’s production year..

Toss Bank | Toss Bank Account “Toss Bank Account” is a savings account that allows you to freely deposit and withdraw money. You can receive interest immediately once a day when you want. The more interest you receive, the more advantageous it is to receive interest. The money in Toss Bank’s bankbook can be used conveniently with Toss Bank’s debit card. www.tossbank.com Toss Bank | Toss Bank Account “Toss Bank Account” is a savings account that allows you to freely deposit and withdraw money. You can receive interest immediately once a day when you want. The more interest you receive, the more advantageous it is to receive interest. The money in Toss Bank’s bankbook can be used conveniently with Toss Bank’s debit card. www.tossbank.com

Toss appeals to the advantage that the fixed deposit products you receive first bind for 3 to 6 months… But it might be better to find interest rate products under better conditions for short-term deposits of 3 to 6 months in the first financial sector than TT. While IBK Day account short-term medium-term bonds cannot protect depositors, they are safe because they are state-run banks, so let’s consider receiving interest while depositing surplus funds. Toss appeals to the advantage that the fixed deposit products you receive first bind for 3 to 6 months… But it might be better to find interest rate products under better conditions for short-term deposits of 3 to 6 months in the first financial sector than TT. While IBK Day account short-term medium-term bonds cannot protect depositors, they are safe because they are state-run banks, so let’s consider receiving interest while depositing surplus funds.

Short-term deposit recommendation lIBK Industrial Bank of Korea D-Day bankbook 200 million short-term medium-term bonds 3.75% (compared to deposit rate) IBK Industrial Bank D-Day bankbook parking bankbook (easy deposit and withdrawal bankbook) interest rate drops to early 3%. blog.naver.com Short-term deposit recommendation lIBK Industrial Bank of Korea D-Day Account Short-term Medium-term Bonds up to 200 million (compared to deposit rates) IBK Industrial Bank of Korea D-Day Account Short-term Medium-term Bonds Parking Account (Sometimes deposit and withdrawal account) interest rates fell to early 3% for 3 months 6…blog.naver.com

★Recent interest rate comparison books are not recommended by savings banks or Internet banks. Please refer to the past summary for the advantages, characteristics, and precautions of parking passbooks ☆>> Parking account interest rate comparison consolidation (latest edition in June 2024) ★ Recent interest rate comparison consolidation books are not in the order of recommendation (savings banks, Internet banks). Please refer to the past summary for the advantages, characteristics, and precautions of parking passbooks ☆>> Parking passbook interest rate comparison and consolidation (latest edition in June 2024)

Please comment on the parts to be corrected 🙂 I will try to update it. 2024 Fighting Please comment on the parts to be corrected 🙂 I will try to update it. 2024 Fighting

> Time deposit rate comparison 10 types summary (latest edition in June) >> Summary of 10 types of fixed deposit rates (latest edition in June)

10 types of fixed deposit rates l 3-month 6-month short-term deposit recommendation (latest interest rate in June) 10 types of fixed-term deposit rates (6-month short-term deposit) June: Comparison of interest rates on fixed deposits: 10 types of interest rates on fixed deposits: blog.naver.com l 3-month 6-month short-term deposit recommendation (latest interest rate in June) 10 types of fixed-term deposit rates (6-month short-term deposit) In June, interest rates on regular deposits were compared, and interest rates were collected through occasional deposit and withdrawal accounts…blog.naver.com

[All Rights Reserved] 토실 댁 [All Rights Reserved] 토실 댁